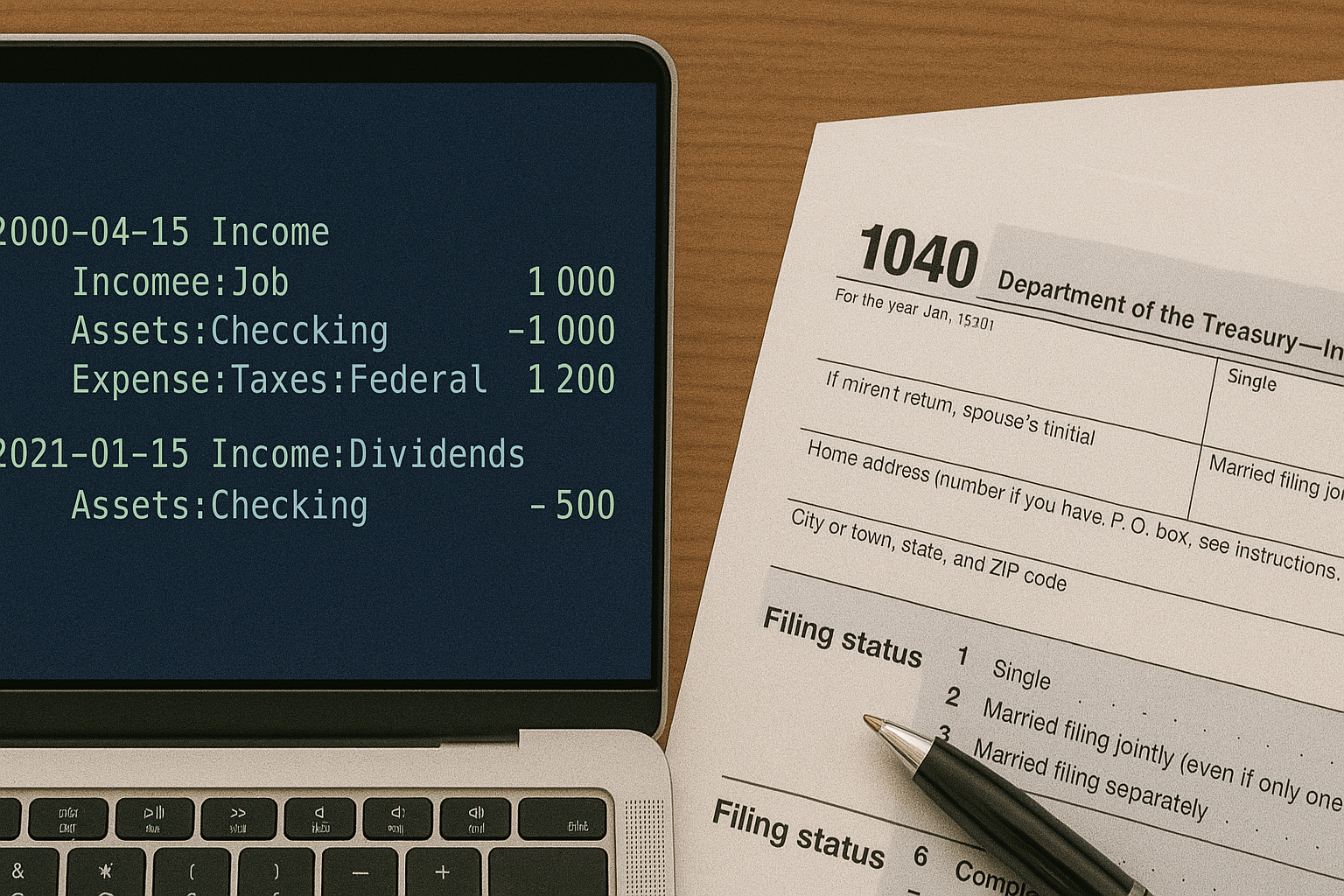

Recording Taxes in Beancount

Introduction Tax accounting is one of the most crucial aspects of personal and business bookkeeping, yet it can be intimidating for newcomers to double-entry accounting systems like Beancount. This guide will walk you through the fundamental concepts and practical techniques for accurately recording various types of taxes in your Beancount ledger. ...